CBDC: Everything You Need to Know

In the age of digital transformation, there is a financial revolution brewing – the emergence of Central Bank Digital Currencies (CBDCs). This cutting-edge concept is taking the financial world by storm, with governments, financial institutions, and the public paying close attention to this innovative solution.

Presently over 100 countries have been developing their own CBDCs, and some of them are ready to roll them up. But what exactly are CBDCs, and why are they causing such a stir?

In this article, we will dive deep into the CBDC meaning and explore what makes this currency so unique. Additionally, we will discuss different types and forms of CBDCs, their benefits, potential drawbacks, and why banks became interested in them.

As we continue to move towards a more digital world, CBDCs have the potential to transform the way we think about money and how we use it. So buckle up, and let us explore this exciting development in the world of finance together by starting with the question — what is CBDC?

What is CBDC?

CBDC or Central Bank Digital Currency is a digital form of fiat currency issued by a central bank or other monetary authority. It is meant to provide the public with an alternative to physical cash, allowing them to make payments and store value digitally.

One of the coolest things about CBDCs is how convenient they are. Unlike physical cash, which can be a hassle to carry around, CBDCs will be super easy to transfer and store securely. Plus, you can use them for both retail and wholesale payments.

But that is not all — CBDCs are also designed to be safe and inclusive. Since they are backed by a central bank, CBDCs are more secure than other digital payment methods, which means you can have peace of mind when you use them. And because CBDCs are digital, they offer an opportunity for people who do not have access to traditional banking services to participate in the economy and access financial services.

CBDCs have the potential to revolutionize the way we make payments and store value. By offering a secure, convenient, and inclusive alternative to physical cash and traditional payment methods, CBDCs could make financial transactions faster, easier, safer, and more cost-effective for everyone. Pretty cool, right?

The evolution of CBDCs: A historical perspective

After understanding the CBDC meaning, it is the perfect time to dive deeper into the origin of CBDC. Central Bank Digital Currencies have a pretty interesting backstory. It all started with the rise of cryptocurrencies like Bitcoin, which were introduced in 2009. These digital currencies are decentralized, meaning that they are not backed by any government or central authority. However, the success of crypto led many central banks and governments around the world to start thinking about creating their own digital currencies. This is where CBDCs come in!

As an additional boost to CBDC development, the 2008 global financial crisis exposed the weaknesses of the traditional financial system, leading to an increased demand for more efficient, transparent, and secure means of conducting transactions. As a response, central banks have begun researching and analyzing the benefits and risks of issuing digital currencies under their supervision.

The rise of private digital currencies like Facebook’s Diem coin (formerly Libra) has also accelerated interest in CBDCs. Regulators and central banks are concerned about the potential impact on monetary policy, financial stability, and consumer protection.

However, the idea of CBDCs really took off on 14 August 2020 when China announced that it was developing a digital version of its currency, the Digital Currency Electronic Payment (DCEP). Since then, many other central banks have been exploring the potential benefits of CBDCs.

The origin of CBDCs is rooted in the growing adoption of digital currencies, technological advancements, and the need for a more secure and efficient financial system. As more central banks continue to research and pilot CBDC projects, further innovations and developments in this emerging market are expected.

The technology behind CBDCs

Basically, the technology behind CBDCs can vary depending on the design choices made by the central bank. However, there are some common features that most CBDC implementations share. One of the key aspects of CBDCs is that they are based on distributed ledger technology (DLT). DLT enables the recording and sharing of transactions across a network of computers in a decentralized and secure manner.

There are two main types of DLT that CBDCs can potentially use: permissioned and permissionless. Permissioned DLT restricts access to the network to a limited number of participants, usually chosen by the central bank. Permissionless DLT, on the other hand, is open to anyone who wants to participate, similar to the Bitcoin blockchain.

Considering the desire of central banks to have full control, CBDCs are expected to operate on a permissioned or private blockchain network, where access and control are limited to a select group of approved participants. This allows the central bank to retain control over the overall money supply.

But, the choice of DLT depends on the goals and objectives of the central bank. Permissioned DLT can typically be used in CBDCs to ensure that only authorized entities, such as banks and financial institutions, can participate in the network. This helps to prevent money laundering, fraud, and other illicit activities. Permissionless DLT, on the other hand, can provide more transparency and openness but may be less secure and harder to control.

Another key feature of CBDCs is that they are programmable. This means that they can be designed to include specific features, such as expiration dates, smart contracts, and other conditions that can be programmed into the currency itself. Programmability enables CBDCs to be used for a wide range of purposes beyond simple payments, such as financial contracts, supply chain management, and other applications.

In addition to DLT and programmability, CBDCs also rely on other technologies, such as cryptography and digital signatures, to ensure the security and integrity of transactions. These technologies help to prevent counterfeiting, double-spending, and other forms of fraud. CBDCs are also designed to be interoperable with existing payment systems, such as credit and debit cards, to ensure that they can be easily used by consumers and businesses.

Different types of CBDS

It is worth mentioning that there are three different types of CBDC to be aware of based on their intended users. These types include retail CBDCs, wholesale CBDCs, and hybrid CBDCs.

Retail CBDCs are designed for the general public and intended to provide a digital alternative to traditional physical cash. With a retail CBDC, individuals can hold and use digital currency issued by their central bank for purchases and transactions. Retail CBDCs can be distinguished into two forms: token-based and account-based (the forms will be explained later on in the article).

On the other hand, wholesale CBDCs are intended for use by financial institutions, such as banks and payment processors. These types of CBDCs are designed to facilitate large-value and high-volume transactions between these institutions in a more efficient and secure way.

Finally, hybrid CBDCs combine elements of both retail and wholesale CBDCs and are designed to meet the needs of both individual users and financial institutions. Hybrid CBDCs could potentially offer the best of both worlds, providing the convenience and accessibility of retail CBDCs while also guaranteeing the security and efficiency benefits of wholesale CBDCs.

So, as you can see, there are different types of CBDCs that are tailored to different users and use cases. Whether you are an individual looking for a digital alternative to cash, or a financial institution in need of a more efficient way to conduct large transactions, there is likely a CBDC that can meet these needs.

Forms of CBDC: Token-based and account-based CBDCs

As mentioned above, retail CBDCs can be implemented using two forms: token-based and account-based. Each of them has distinct characteristics and implications for the financial ecosystem, privacy, and security. Here is a short overview of both approaches.

Token-based CBDCs

Token-based CBDCs are based on digital tokens, which represent a specific amount of currency and can be stored directly on a user’s device. These tokens are stored in a digital wallet and can be transferred from one wallet to another without the need for a centralized database. Token-based CBDCs use DLT to keep track of transactions and balances.

This is exactly how a token-based system works — the token represents the value of the currency, and if it is valid, it can be used to make a purchase.

Account-based CBDCs

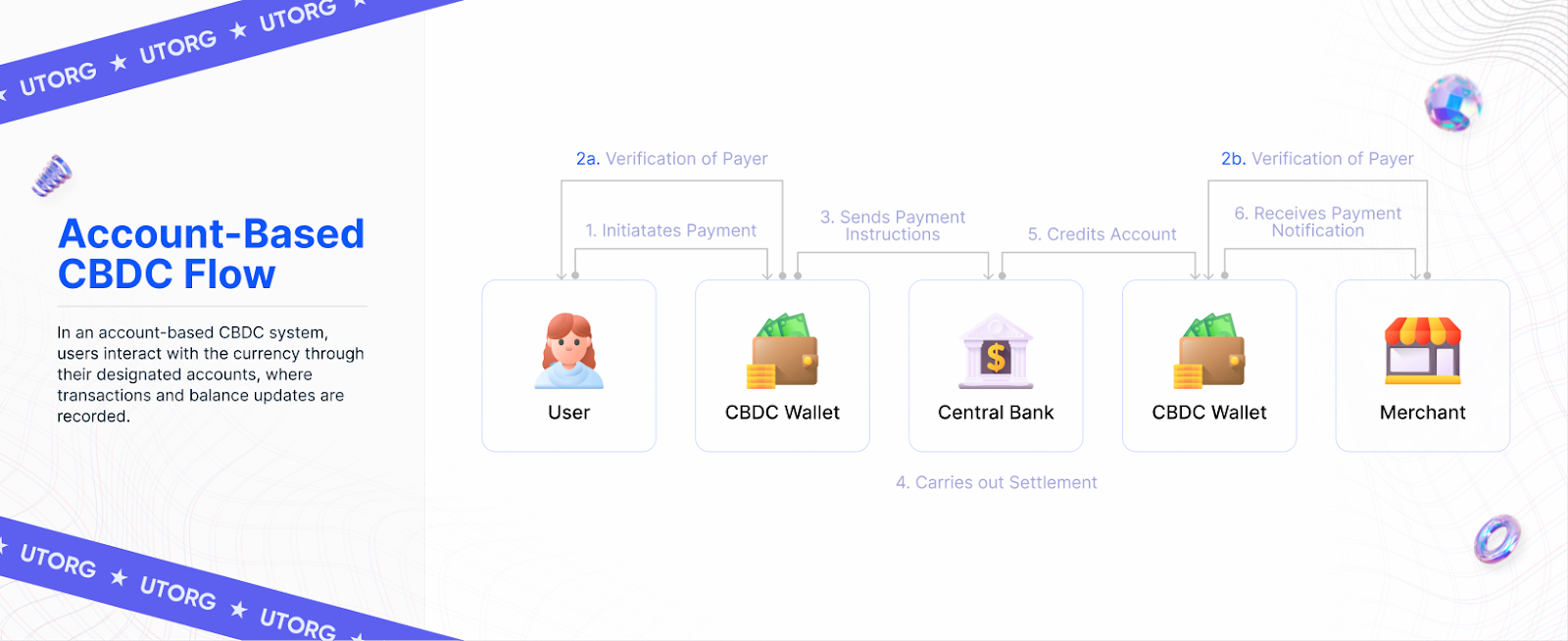

In contrast, account-based CBDCs are similar to traditional bank accounts. They are linked to an individual’s identity and provide direct access to the central bank’s balance sheet. Account-based CBDCs enable individuals to store funds and make payments directly from their accounts. These types of CBDCs require a centralized database to keep track of account balances and transactions.

The difference between CBDCs, cryptocurrencies, and stablecoins

CBDCs, cryptocurrencies, and stablecoins are all forms of digital currencies, but there are significant differences between them.

CBDCs are digital versions of fiat money that are issued and backed by a central bank. CBDCs are designed to be legal tender and are intended to be used for everyday transactions, just like a physical currency. The main purpose of CBDCs is to increase the efficiency and security of the payment system and to provide an alternative to traditional payment methods.

Cryptocurrencies, on the other hand, are a little different. They are also digital currencies, but they do not rely on banks or the government to work. Instead, they use a special computer network to operate. Cryptocurrencies are focused on making sure your money is safe and private, so you can have more control over it.

Finally, there are stablecoins. These are digital currencies that are designed to be stable in value, which means they will not go up or down in value too much. They are often tied to other things, like regular money, to help make sure their value stays stable. Stablecoins are a good choice for people who want to use digital currencies but do not want to worry about their value changing too much.

As you notice, the primary differences between CBDCs, cryptocurrencies, and stablecoins lie in the following:

- Authority. CBDCs are authorized and supported by central banks, which means they are regulated by the government. Stablecoins, on the other hand, are usually created by private companies, and cryptocurrencies are decentralized and not controlled by any government or central authority.

- Stability. Stablecoins are designed to be stable in value, often by being tied to other assets like regular money or precious metals. This helps to prevent large fluctuations in value that can sometimes occur with cryptocurrencies. CBDCs, like regular money, have a stable value because they are backed by the government.

- Purpose. CBDCs are designed to be a digital version of regular money, making it easy to buy things and store your money digitally. Cryptocurrencies are designed to provide a decentralized, secure, and private way to store and transfer value without the need for banks or governments. Stablecoins, as the name suggests, are designed to be stable in value and can be used as a form of digital currency that is less volatile than traditional cryptocurrencies.

Advantages of CBDC

CBDCs have some potential advantages over traditional currency and other forms of digital currency. Let us take a look at some of the advantages of CBDCs:

- Increased financial inclusion. CBDC has the potential to provide access to financial services for people who are unbanked or underbanked, as it does not require access to traditional banking infrastructure.

- Reduced transaction costs. CBDC can reduce transaction costs and speed up the settlement process compared to traditional payment methods.

- Enhanced security. CBDC is designed to be more secure compared to traditional currency, as it uses advanced encryption technology and other security measures inherent to crypto.

- Improved monetary policy. CBDC can help central banks implement more efficient monetary policies by providing them with greater visibility into the economy.

- Counteracting currency risks. CBDC can help to reduce risks associated with cross-border transactions and currency fluctuations, as it can be used as a form of digital currency that is backed by a central authority.

- Improved payment efficiency. CBDC can improve payment efficiency by providing users with a faster and more secure way to make transactions without the need for intermediaries.

- Greater financial stability. CBDC can help to promote financial stability by providing central banks with greater control over the economy and reducing the risk of financial crises.

Disadvantages of CBDC

Besides the potential advantages of CBDC, these digital currencies have their drawbacks. Here are some of CBDC disadvantages:

- Cybersecurity risks. CBDC can be vulnerable to cyber attacks, and any breach of security can result in the loss of user funds.

- Privacy concerns. CBDC requires users to provide personal information and undergo verification procedures, which raises concerns about privacy.

- Disruption of traditional banking. The implementation of CBDC can lead to the disruption of traditional banking systems and the displacement of traditional financial institutions.

- Technical complexity. CBDC can be more technically complex to implement and use compared to traditional currency, requiring users to have a certain level of technical expertise.

- Economic implications. The implementation of CBDC can have significant economic implications, such as the potential for changes in interest rates and inflation, which can have unintended consequences.

- Centralization. CBDC is issued and controlled by a central authority, which raises concerns about centralization and the potential for political and economic pressures to influence the currency.

- High costs. The cost of developing and implementing CBDC can be high, and these costs may be passed on to users in the form of fees.

4 reasons why central banks became interested in CBDC

The monetary landscape is witnessing a paradigm shift, with Central Bank Digital Currencies capturing the attention of central banks worldwide. This burgeoning interest stems from four salient trends that have left an indelible mark on the global financial ecosystem.

#1 evolving cash dynamics. In recent years, more and more people have been using digital money instead of physical cash. With Europe witnessing a one-third decrease in cash usage between 2014 and 2021 and a mere 3% of transactions in Norway involving cash, the potential merits of CBDCs have emerged as a subject of exploration.

#2 surge in private digital assets. There are a lot of private digital assets, like cryptocurrencies, that people are using instead of regular money. CBDCs could be a way for central banks to counteract this trend and keep regular money as the main way people measure value. With 10% of UK adults and up to 10% of households in six major EU nations reporting digital asset ownership, central banks are contemplating CBDCs as a viable countermeasure.

#3 reasserting central banks’ innovative prowess. Introducing CBDCs is a chance for central banks to be innovative and come up with new ideas for how we use money in our daily lives.

#4 enhancing local governance over global payment systems. CBDCs could help local economies and make it easier for people to use digital money in their own regions.

In this increasingly digitized world, CBDCs have surfaced as potential panaceas for the challenges confronting the extant monetary landscape. Central banks are thus delving into the prospective merits of CBDCs, seeking to foster financial stability and spur innovation in the financial sector.

Endnotes

To sum up, Central Bank Digital Currencies are a game-changer in the world of digital finance, holding the key to greater financial inclusion, security, and efficiency. Despite being in the early stages of development, CBDCs have already set the ball rolling among governments, central banks, and industry players, sparking off a wave of innovation and progress.

As CBDCs continue to gather steam and evolve, it is paramount for stakeholders to put their heads together to tackle the opportunities and challenges that lie ahead. This entails ensuring that CBDCs are tailor-made to cater to the needs of all users, from individuals to businesses and governments, while also addressing concerns around privacy, security, and regulation.

All in all, the emergence of CBDC is a breath of fresh air in the realm of finance, marking a significant shift in how we view money and the role of central banks in the digital age. We are living in exciting times for finance, and it is only a matter of time before we witness many more fascinating twists and turns.

FAQ

1. What is Central Bank Digital Currency?

CBDC stands for Central Bank Digital Currency, a digital form of a country's fiat money issued and regulated by its central bank.

2. Is CBDC a cryptocurrency?

CBDC is not a cryptocurrency but a digital fiat currency issued by central banks. While it shares some features with cryptocurrencies, it is centrally controlled and regulated, unlike decentralized cryptocurrencies like Bitcoin.

3. Will CBDC replace cash?

CBDC may coexist with cash but not necessarily replace it entirely, as people might still prefer using the physical currency for privacy, accessibility, or cultural reasons. The extent of cash replacement will depend on CBDC adoption and central bank policies.

4. What will CBDC be backed by?

CBDC will be backed by the issuing country's central bank, representing a liability on its balance sheet. It is supported by the nation's monetary policy, economic stability, and trust in the government and central bank.